PRICES

Sale and purchase of residential property

Rhodes & Walker fees cover all of the work required to complete the purchase of your new home, including dealing with registration at the Land Registry and dealing with payment of Stamp Duty Land Tax if the property is in England, or Land Transaction Tax if the property you purchase is in Wales.

STAMP DUTY LAND TAX

This depends on the purchase price of your property and your circumstances. You can calculate the amount you will need to pay by using HMRC’s website here

https://www.gov.uk/stamp-duty-land-tax

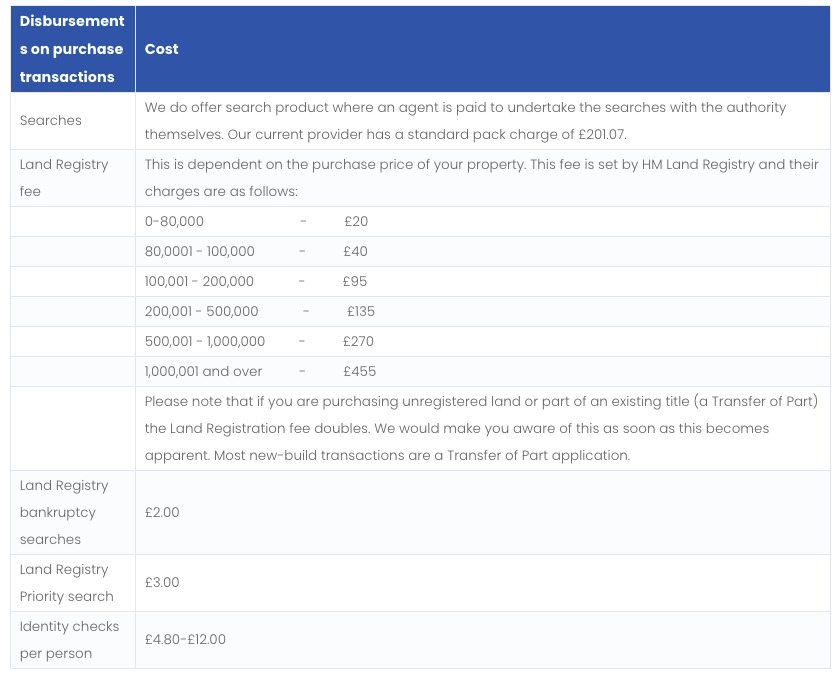

THIRD PARTY CHARGES

We aim to provide an accurate quote from the outset so that you know exactly how much you will have to pay. It is important that you give us as much information as possible to ensure that your quote is complete. There may be some additional fees payable, if unknown information comes to light, as the transaction progresses.

There are in some cases additional costs that need to be paid to third parties that we cannot always quote for at the outset of a transaction. We will of course make you aware as soon as these costs arise. These are most commonly found in leasehold transactions, but can sometimes appear in freehold purchases of properties on estates with ‘managed areas.’

ADDITIONAL SERVICES OR FACTORS

If you instruct us via a referral agent that may increase overall costs. The referral agent will provide you with a detailed quote which you may decide whether or not to accept.